Shortly after we rang in the New Year, a new Congress was sworn in on Capitol Hill. The 119th Congress has a full slate of work ahead covering a range of issues, but our mission at the American Sugar Alliance remains the same: educate policymakers on the importance of America’s sugarbeet and sugarcane farmers to our national food supply.

To help us do that, we rely on timely and accurate data from the U.S. Department of Agriculture (USDA). Throughout the year, USDA issues important reports with valuable data that underscore the value of farmers and the value of U.S. sugar policy.

First things first. In November, USDA provided an update to its Food Dollar Series. This is a data series that measures annual expenditures of U.S. consumers on domestically produced food-at-home as well as away-from-home. In other words, how much money are Americans spending at the grocery store, how much are they spending eating out at restaurants, and where exactly does all that money go?

The answers are illuminating. The data released on November 18, 2024, shows that the overall amount of the food dollar that goes to the farm is about 15.9 cents, which means that 84.1 cents goes to the “marketing share” of the food dollar. The marketing share can also be thought of as the value of post-farm activities that turn farm production into finished food products at the grocery store.

Another way to analyze the food dollar is to look at the various supply chain components.

When considered this way, the farm production portion is only 9.1 cents and food processing is 13.2 cents (some food processing occurs on the farm, but they are split out differently for this food dollar statistic).

Food service is the largest component of this food dollar, making up 31.5 cents of each dollar.

Most Americans do not realize that hardworking farmers receive such a small percentage of the food dollar. In fact, a 2020 survey conducted by the American Sugar Alliance found that the average consumer believes that sugar producers receive one dollar for every pound of sugar they produce – instead of a fraction of that amount which mainly goes toward paying for the costs of producing sugarbeets and sugarcane. America’s sugarbeet and sugarcane farmers are an essential part of our affordable and reliable food supply, and that’s a message we will be taking to Congress in the coming months.

Thinking of consumers, we also track how prices at the grocery store have been changing and are likely to change over time. In October, USDA also released a forecast of the Consumer Price Index (CPI) for food that suggested that sugar and sweets prices will grow by 2.4 percent in 2024 and then flatten to 0.6 percent in 2025. That comes off of a 10.4 percent increase in 2022 and 8.7 percent increase in 2023.

Given that most of the cost of sugar at the grocery store goes to the retail margin, we don’t expect those changes in grocery store prices to have much impact on the value of sugarbeet and sugarcane production.

Next, let’s turn to the new 10-year commodity projections for USDA. The baseline projections are pulled together by the USDA’s Office of the Chief Economist by the same analysts who work on the World Agricultural Supply and Demand Estimates (WASDE)’s each month.

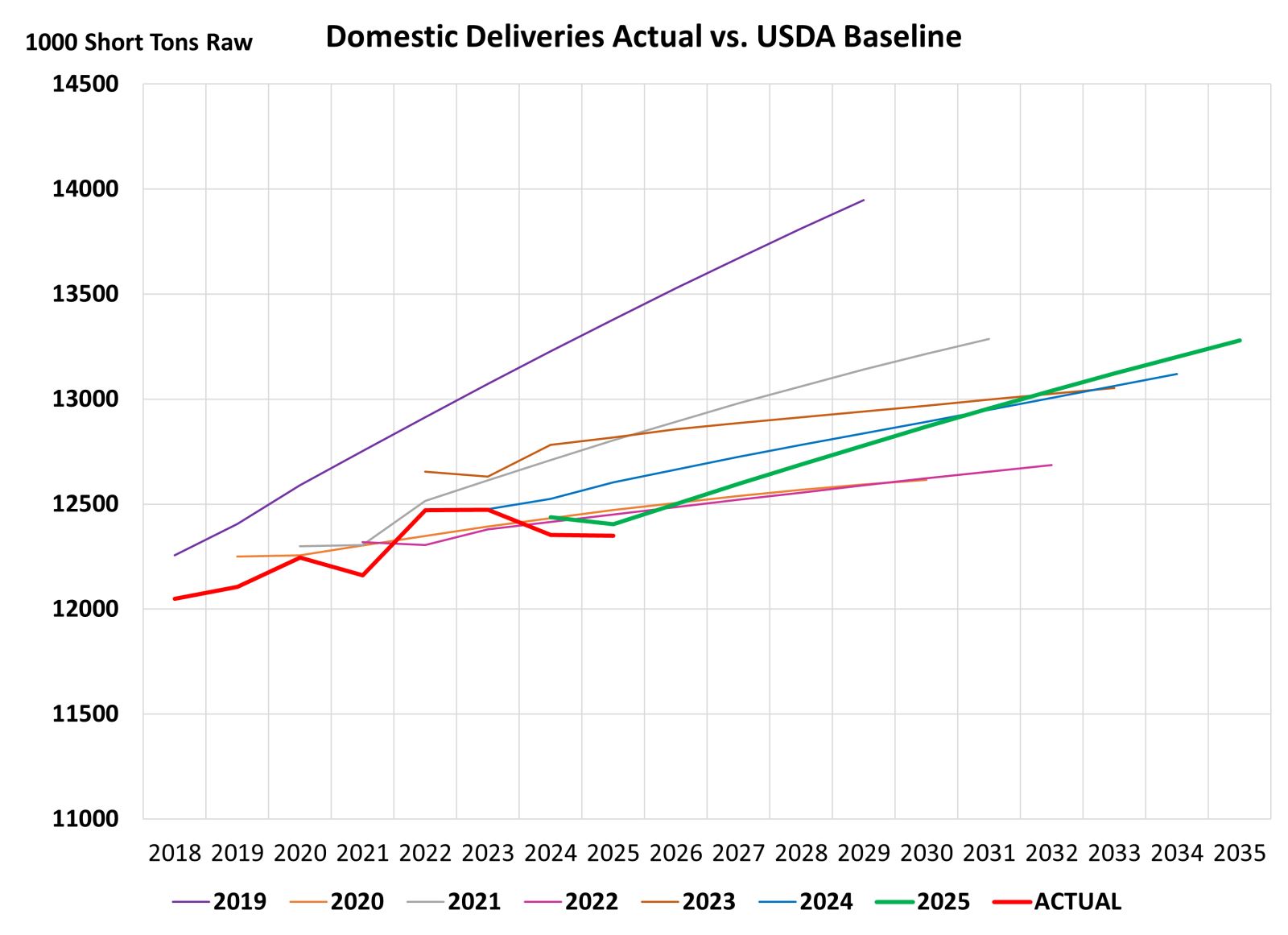

Looking at the new spending projections, USDA is forecasting a continuing increase in demand for sugar in the United States. Domestic deliveries in the most recent forecast suggest demand will rise by almost 1,000 short tons raw value (STRV) over the next 10 years (or +7.5 percent).

In the figure below, we have also included the actual demand for sugar as well as previous years’ forecasts. USDA was quite optimistic for sugar demand when they did their 2019 10-year forecast and much more pessimistic in 2020. However, the recent forecast does show a much more positive trend in demand with the 7.5 percent growth expected over 10 years.

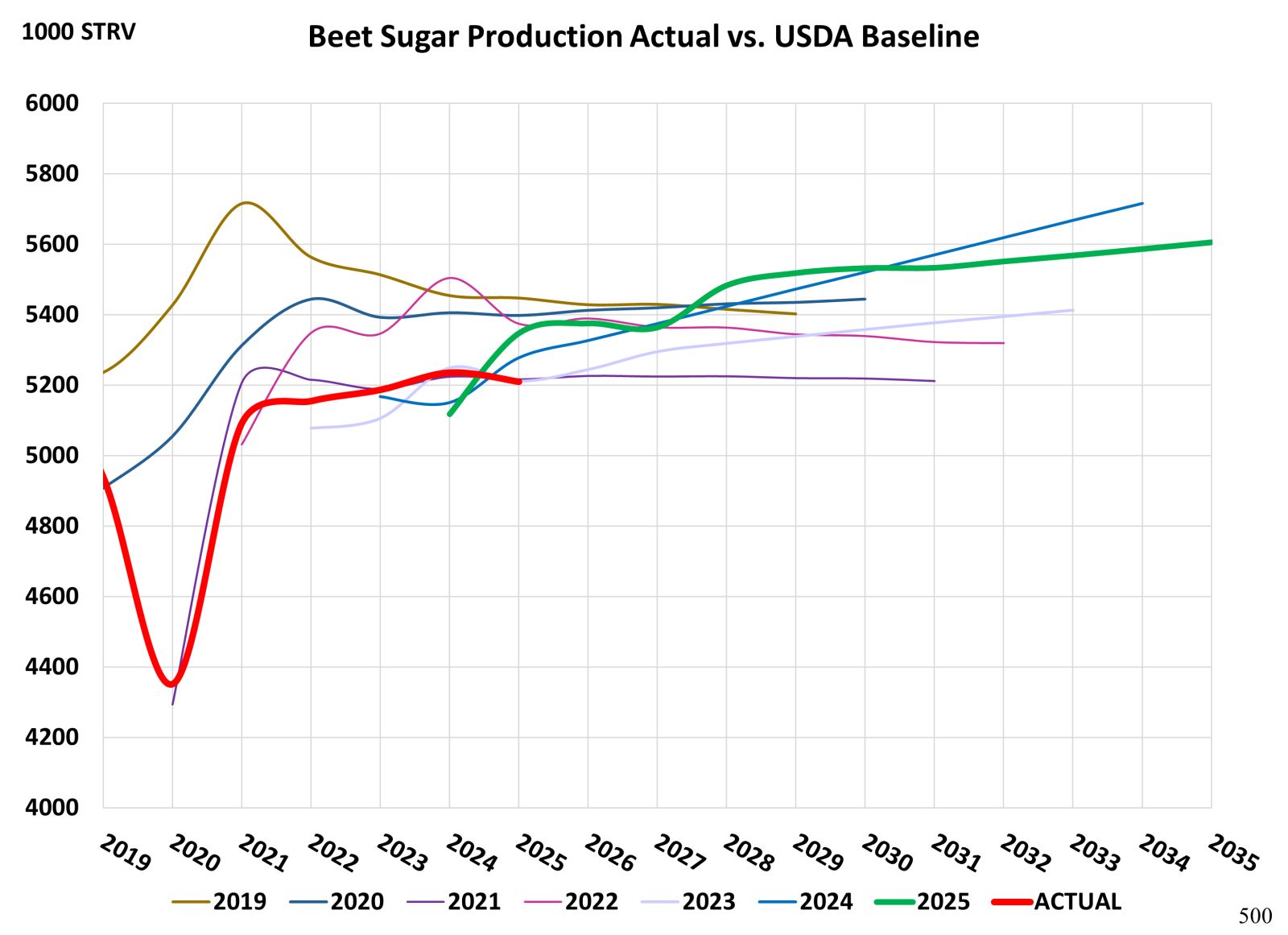

Beet sugar production is expected to grow from about 5.2 million STRV to almost 5.6 million STRV over the 10-year forecast period.

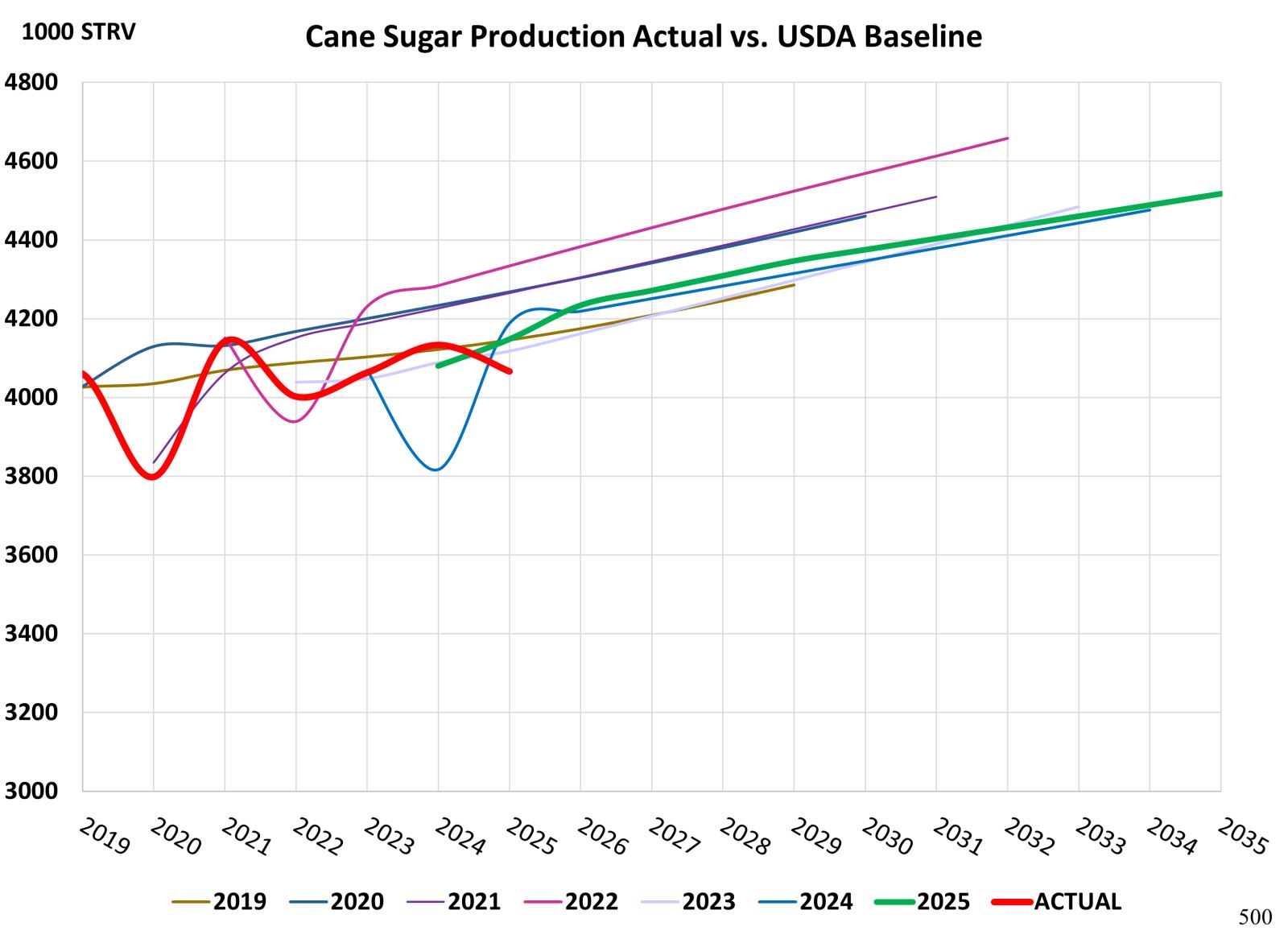

Cane sugar production is expected to grow from about 4.1 million STRV to almost 4.5 million STRV over the 10-year forecast period.

Overall domestic sugar production is expected to rise by 9.2 mil STRV today to more than 10.1 mil STRV by the end of the forecast period, accounting for nearly the entire forecast demand increase. Our farmers are continuing to invest in sustainable farming practices and becoming ever more efficient as we work to feed the growing demand for sugar in the U.S. Of course, our farmers are supported by the hard work of our skilled factory workers, our strong and resilient sugar supply chain, and the safety net provided by U.S. sugar policy.

We also look forward to the USDA-ERS Farm Income report to be released in February 2025, when we’ll see the new estimates for 2025 and the final estimates for 2024. Those estimates will be closely watched for signs of a deepening farm crisis across American agriculture.

Either way, we will continue to share the importance of a viable and reliable domestic sugar supply to meet the needs of American families and food manufacturers. And we’ll continue to highlight the need for a stronger, more effective 5-year Farm Bill.